Should I lease it or buy it? This is the common question that every car buyer faces. This guide aims to help you make an informed decision by detailing what a car lease is, the different types of car leases available, and the pros and cons of both the options. In this guide, we will start with the basics and then delve deeper into the nuances of each option giving you a better understanding of whether to lease or buy a car.

In simple words, a car lease is a contract between the two parties, a lessor and a lessee. In this instance, the lessor – Motorfinity Leasing - leases the vehicle to the lessee. In laypersons terms, car leasing is when you get to keep the car for 2-3 years - it can be more or less depending on the contract - and pay monthly fees for the specified period. You will be responsible for any maintenance and repairs during that time.

For leasing, the payments are calculated based on several factors and not only based on the purchase price. The most critical factors are purchase price, residual value (the estimated value of the car at the end of the last term), the lease term, the interest rate, and any additional fees or taxes. To calculate a car leasing offer, see the following below:

The information can easily be determined as part of the residual value. You can use the money calculator: how much could a car be worth to see the estimated residual value of your vehicle at any point in time.

Please note, this is just an example, and in an actual car package, the lease is affected by taxes, fees, and the specific terms of your lease agreement. Also, be aware that the car lease does not include insurance. This is typically separate and comes as an additional cost.

Even though the difference between finance and leasing is self-explanatory, the terms PCP, PCH, and hire purchase are often mixed. PCP and Hire Purchase are classified under finance. PCP (Personal Contract Finance) is where you spread the price of the car across a deposit, monthly, and optional final payment. HP (Hire Purchase) is where you get to own the vehicle at the end of the contract, and you don’t have to pay any balloon or final payment - the monthly fee adds up to the total cost of the car. You can also read our comprehensive piece on PCP and HP finance where we go into much more detail about the main differences.

On the other hand, PCH (Personal Contract Hire) is the most common leasing type. Here, you lease a vehicle for personal use with fixed monthly payment options and have no options to buy the car at the end of the lease term.

Compared to financing, leasing has lower monthly payments. When you lease a car, you are essentially paying for the depreciation of the vehicle rather than the full value of the car, as is the case with financing. The other main benefit is that there is no torturous balloon payment at the end of the contract.

Buying a car involves taking out a loan or paying cash for the total purchase price of the vehicle. With this option, you become the car owner and are responsible for all maintenance and repair costs.

The world is shifting from an ownership model to a usage one. Take the example of DVDs versus streaming platforms such as Netflix and Amazon.

The other way to look at it is the convenience and flexibility. You are in charge of how long you are going to keep the car, you are in control of your finances (there is no humongous balloon payment coming up resulting in sleepless nights), you are not being tied to one car, you have the luxury of getting the newest model and still stay in budget. All these perks and flexibility make the leasing market very attractive.

As discussed above, leasing a car offers lower monthly payments than financing the exact, same vehicle.

One of the significant advantages of leasing is, of course, no down payments. There is no need to break the bank to get an absolute necessity.

The other benefit is the eligibility for the tax relief. However, this depends on your contract, as personal car leasing is not eligible for tax relief, but business car leasing is. In business car leasing, you can claim monthly tax relief on rental payments.

The other benefit is no minor maintenance. Your car is under warranty for the entire contract duration, making you more secure.

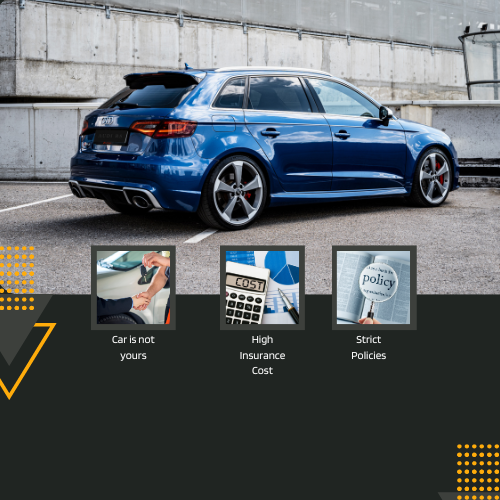

You don’t own or have the option to own the car. Car leasing is increasing but this is why car finance still owns 70% of the total UK car market share.

Excluding ourselves, the leasing terms and conditions can be deemed as strict for some individuals. The key policies include mileage limits, wear and tear guidelines, maintenance requirements, and early termination fees. All lessees are advised to carefully review and understand the terms and conditions of the lease agreement before signing.

The annual mileage is capped which means any miles above it would be charged.

Car leasing often has high insurance coverage costs compared to an outright purchase car.

At the end of the leasing, the car is often inspected by the third party, and the lessee bears the third party fees.

This can be both good and bad. If you stick to your leasing terms, it will positively affect your credit score; however, due to strict leasing policies, holding on to leasing terms can be challenging, which can incorrectly affect your credit score.

Buying a car involves taking out a loan or paying cash for the total purchase price of the vehicle. With this option, you become the car owner and are responsible for all maintenance and repair costs.

Though the main difference between buying and leasing is the ownership, the difference between the both is blurred when you can buy the car at the end of your leasing term. So to answer the question, can you buy the vehicle at the end of the lease terms? Yes, you can if it is written in your leasing contract. But is it a good idea, though? We discuss this in detail below.

In short, it depends, it depends on your preferences, but when it comes to economies, it may not be a good idea to buy your lease car, and here it is why:

In most cases, the buyout price at the end of the lease is based on the vehicle's residual value, which is calculated and determined at the end of the lease. This value is often higher than the current value of the car, meaning that buying the car at the end of the lease may be costly.

So now, if you have decided to buy a car you have driven for years, the maintenance and repair cost for which you are responsible can be an issue.

Cars depreciate over time, and if you buy the vehicle at the end of the lease, you may be purchasing a car that has already lost a significant amount of value.

One of the major perks of leasing a car which I will come on later is the ability to return the vehicle at the end of the lease and choose a new one. By going with the same car, you are missing out on the luxury of owning the latest model of your favourite car.

Now we all know one benefit of buying a car, and it is that it allows you to own a car, so we won't mention that, but as compared to leasing disadvantages, buying a car can eliminate all those risks and demerits of leasing a car, for instance:

When buying a car, you don’t have any mileage restrictions; no monthly alerts email tells you that you are exceeding your mileage limit, and you have absolute authority over how much you want to drive.

You re the actual owner of the car and it is your car, you can modify it in what every way you want. Didn’t like the bland back of your car? You can modify it with a boot spoiler.

In terms of a long time, buying a car is always a cheaper option and outweighs both finance and leasing.

No matter how much we say that world is moving towards a more usage model than ownership for most people, a car is not just a medium to communicate from point A to B. From most of you out there, it is part of a family, it is your self-identity, so when buying a car, you don’t have to worry about returning to the leasing company at the end of the contract term.

This is because you are responsible for paying the full cost of the car instead of just the portion of its value that you use during a lease term. Additionally, in the UK, finance rates have been steadily increasing, which further contributes to the higher monthly cost of buying a car.

This means you are committed to making payments on the car for a longer period of time, which can limit financial flexibility.

As new cars can lose 15-25% of their value in the first five years of ownership. This means that if you decide to sell your car in the future, you may not be able to recoup as much money as you originally paid for it. This can be particularly problematic if you took out a loan to finance the car and still owe the money on it when you want to sell.

Selling a car is a time-consuming process. Finding a buyer, negotiating a price, and doing the paperwork all can be a daunting task. Additionally, if you still owe money on the car, you need to pay off the remaining balance before you can transfer ownership to the new buyer.

Ultimately, the best way to buy a car is the one that fits your budget and lifestyle. Be sure to include the total cost of ownership, including maintenance, insurance, and fuel costs, when making your decisions.

Outright purchase can be a good option if you have the financial means to pay for a car upfront. It is a good option as you are saving yourself from high-interest rates and fees that are associated with financing.

On the other hand, financing is a good option if you don’t have the cash in hand to make an outright purchase.

It all comes down to own individual preferences, financial situation, and driving habits. However, looking at the data tells us that the average duration or average length of time a person keeps a car is 4 years (according to research by auto traders. The average length of time a person keeps a car is an important factor to consider when deciding whether to buy it or lease it. If you plan to keep the car for a long period of time, buying may be a better option since you will own the car outright. However, if you prefer to have a new car every few years, leasing may be a better option, as you can return the car at the end of the lease term and lease a new one without having to worry about selling the car or dealing with depreciation.

At Motorfinity Leasing, we mitigate the risk of all the potential drawbacks of leasing discussed above. Our leasing package is specifically tailored to you. We don;t have any hidden costs. We have one monthly cost (no down payments), and above all, we are simple and quick. From inquiry to doorstep delivery, we keep you informed all the way.

At Motorfinity, we specialise in providing discounts on brand-new cars for frontline workers, including members of the Armed Forces, Police, NHS workers, Education and Social Care, and more.